Junior Tax Manager

We have subsidiaries in 4 countries and sales in over 50, making your role essential for ensuring compliance in each market. You’ll manage the recording, reporting, and remittance of VAT & sales tax!

We usually respond within two weeks

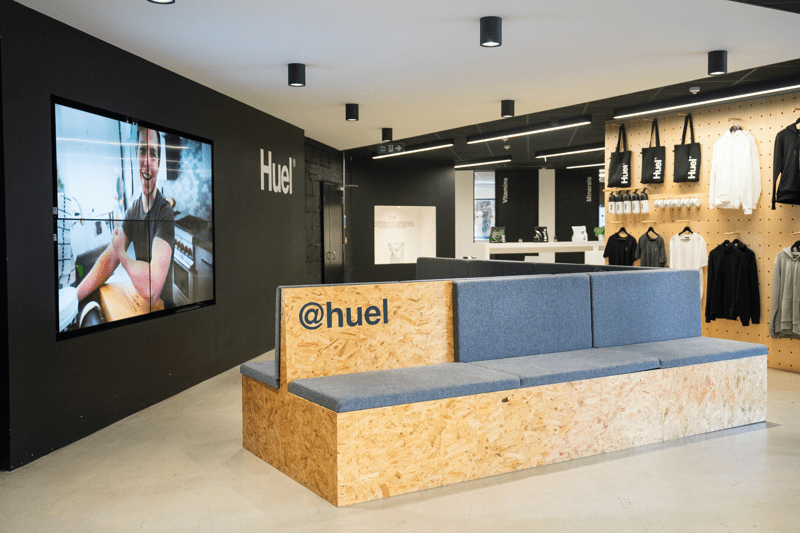

Hey! We're Huel, and we're pleased to meet you 👋

Our culture thrives on high performance, and we set the bar high for new Hueligans who join us.

We invite you to read the advert below for our new Junior Tax Manager position to understand the role, and explore our 7 Huel values before applying to ensure we have the right working environment for you!

The role

Due to team growth and business expansion, we have a brand new position available as a Junior Tax Manager. In this role, you will be responsible for assisting with all aspects of VAT and indirect tax compliance for Huel globally. We’re a rapidly growing business with subsidiaries in four countries and selling in over 50, so your role is critical in making sure that we’re treating our products correctly in each market. Here's what you'll get up to :

- You’ll be recording, reporting and remitting the right amount of VAT and sales taxes, as well as other duties and levies.

- Support the preparation of the VAT returns in the EMEA, liaising with tax advisors.

- Oversight of VAT submissions and payments, ensuring on-time delivery and compliance

- Process owner for indirect taxes, including being accountable for the overall control environment for indirect taxes

- Providing technical input and support for Intrastat and EC sales listing declarations

- Dealing with VAT correspondence and notices from tax authorities, including key role assisting with Indirect tax audits - providing data and responding to queries

- Supporting the interpretation and development of analytical reviews of new indirect tax policies, procedures and regulations

- Supporting the Team in the advancement of the long-term VAT technology strategy in relation to the Markets business - Making Tax Digital

- Work closely with the business to raise awareness of VAT issues, provide guidance on invoicing and the review of VAT accounting entries and ledgers

- Assisting with other areas of indirect taxes, such as packaging taxes and duties

- Support the Head of Tax, on some ad hoc tax and customs projects, issues and opportunities arising in the UK and Internationally

Click HERE to read a more detailed job description.

What we're looking for in you

We’re looking for new Hueligans who thrive in a high-performance environment and are driven by an unwavering pursuit of excellence. We want individuals who aren’t afraid to think outside the box and hold themselves accountable. If you’re excited about setting ambitious targets and believe that extraordinary results come from innovative thinking and strong teamwork, you’ll be a perfect fit for life at Huel

- Roughly 3 years of experience in a multinational company either ideally in an indirect tax function, or from an accounting and tax services advisory firm

- Professional qualification in accounting or tax preferred –e.g. CTA or ACA with working experience in rax

- Advanced Excel skills (Vlookups, Pivot tables, Sum If, etc)

- Excellent organisational skills, with proven ability to prioritise tasks and meet deadlines

- Good interpersonal and communication skills, having the confidence to communicate clearly with senior management and challenge commercial teams

What do we offer in return?

We know that at times, our teams face demanding pressures, and exceptional effort deserves meaningful rewards. That's why we've created a world-class perks and benefits program designed to support our Hueligans in achieving their best, both professionally and personally, while celebrating the global impact they're making!

🕖 Hybrid working - We spend Mondays, Tuesdays and Thursdays in the office together. The remaining two days have the option to be worked from home.

🌴 30 days annual leave PLUS bank holidays

🥤 Free Huel to keep you going

🏖️ 2 weeks a year to work remotely from anywhere! One week in the Summer and one week at Christmas

🐾 Dog friendly

🙋 Paid Volunteering Days

🏋️ Free on-site gym with free classes, and we will give you your own nutrition plan

🧠 Free 1-on-1 therapy provided by Self-Space.

🏥 Private Medical and Health insurance for you and your loved ones, including free life insurance covering up to 4x your salary

⚡ Electric Car Scheme with onsite charging

🤰 Enhanced Family Leave

👪 Workplace Nursery Scheme

🎓 Huel Academy

💸 Paid Employee Referral Scheme

🎉 Biannual events to celebrate success - Have you heard about Huelchella?

We are Hueligans

We know that diversity isn't just important; it’s essential, and it makes us stronger. We're all about embracing our differences, celebrating what makes us unique, and bringing together Hueligans from all walks of life.

Whilst we all share the 7 values of Huel, it’s our individual differences that truly enhance our culture of belonging. We seek out Hueligans from around the world, encouraging authenticity, diverse views, and fresh ideas to create products that our global customers love.

Meet our teams here.

Junior Tax Manager

We have subsidiaries in 4 countries and sales in over 50, making your role essential for ensuring compliance in each market. You’ll manage the recording, reporting, and remittance of VAT & sales tax!

Loading application form

Already working at Huel?

Let’s recruit together and find your next colleague.